We are in the fourth quarter of 2019 and mergers and acquisitions deal data is now available through the end of the third quarter 2019. In this report, we review our region’s most active industry sectors and offer an outlook for Winter 2019/20.

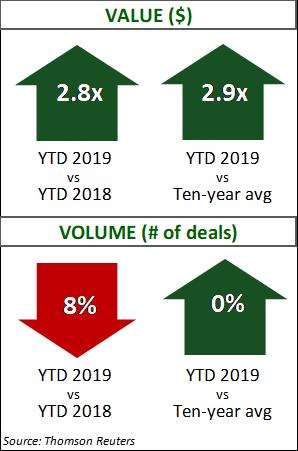

Overall, deal valuations remain high, with continuing volume and value of transactions. Founder-owned, privately-held companies in active industries continue to be in high demand for acquisitions.

M&A Transaction Report by Sector

I. Aerospace

Analysts are positive on aerospace market fundamentals, which drive continuing strong deal activity.

Highlights:

- Quarter over quarter, deal activity weakened after the UTC/Raytheon deal, but remained positive longer term.

- As with most major transaction, the UTC/Raytheon transaction should drive downstream acquisition activity.

- One area to watch: US Department of Defense announced new cybersecurity contractor standards effective January 2020 (Cybersecurity Maturity Model Certification), which will be necessary when bidding for defense contracts. Consequently, more stringent requirements typically lead to consolidation, with companies investing to meet new standards, be acquired or lag the market.

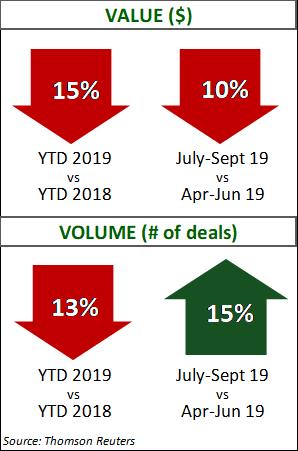

II. Chemicals

With deal value and volume down year over year, analysts continue to attribute the decline to geopolitical tension, trade/tariff uncertainty, and the possibility of a slowing economy. The only bright spot; an increase in the number of deals since Q2.

Highlights:

- Due to the current macroeconomic environment, analysts are urging chemical companies to review supply chains and potential business impact of proposed regulations and trade wars. This in turn will impact acquisition and divestiture strategy.

- Specialty Chemicals maintained the highest valuations again this quarter, although there are fewer viable acquisition candidates now remaining in this sub-sector.

- Available cash for strategic and private equity investors will fuel chemicals deal activity, although analysts predict flat or slightly declining valuations and volumes in the future.

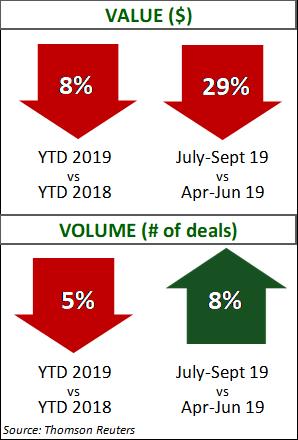

III. Construction and Engineering

The headwinds faced by the Construction and Engineering industry overpowered the strong underlying fundamentals for a disappointing third quarter.

Highlights:

- Continued concern over a slowing economy and trade uncertainty weighed on deal activity in Q3, with an increase in deal volume versus the prior quarter the only positive data set in this report.

- The Mortgage Bankers Association forecasted mortgage originations to be 32% higher than previous year. With the increasing demand for homes and resulting growth of residential construction, suppliers to construction could expect an upward trend.

- Labor shortages continue with the Commercial Construction Index reporting that 61% of firms need more workers.

- Tariff effects declined for parts of the industry as exemptions were announced for some key construction materials and equipment.

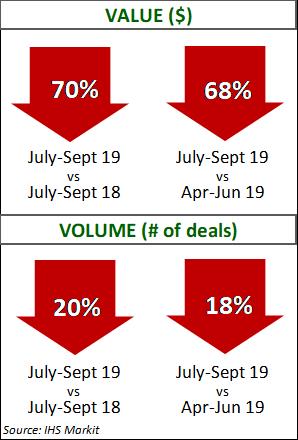

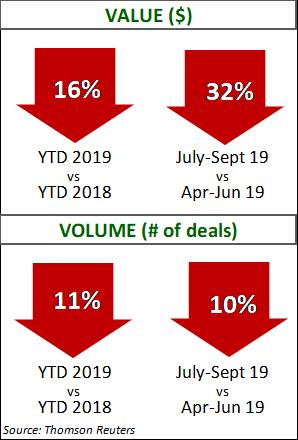

IV. Energy: Oil and Gas

As we discussed in our previous quarter report, volatility in energy and declining drilling activity is dirving declining asset values and M&A activity. Analysts credit limited capital accessibility and a pessimistic outlook on crude pricing for the steep declines in deal value this quarter.

Highlights:

- The upstream sub-sector led in deal value and volume, followed closely by midstream. Downstream and Oilfield Services deal activity remained muted.

- Historically, deal activity increases in volumes or values during the fourth quarter to beat year end. Factors that will contribute to future deal activities include: i) need to create scale; ii) producing positive cash flows and shareholder value; and iii) troubled companies seeking to be acquired or restructuring through bankruptcy.

- Analysts have noted the strategy of smaller firms expanding operations by acquiring companies with producing wells, bypassing the risk and expense of oil exploration. There is growing separation in the market to either focus on: i) exploration and proving out a well; vs ii) producing a well. Private equity has been a significant driver of this changing landscape.

- Notable transactions this quarter: Hilcorp Energy acquiring BP’s Alaska assets, Energy Transfer’s acquisition of SemGroup, and Blackstone’s acquisition of Tallgrass Energy.

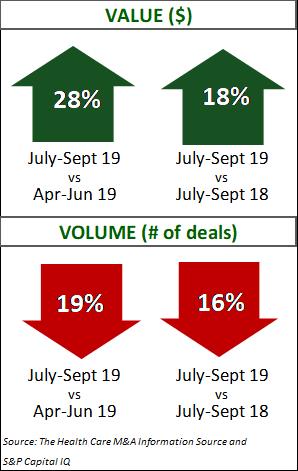

V. Healthcare

Analysts expect Healthcare M&A to remain relatively consistent though 2019 due to their strategic value and capital availability budgeted for acquisitions.

Highlights:

- The long-standing sector trends, including high costs, volume pressure, and dealing with the Affordable Care Act provisions amidst legislative uncertainty, will also continue to influence strategy and deal activity.

- Long Term Care remains in the top spot for deal volume and value. Physician Medical Groups were second in deal volume and Hospitals were the second sub-sector in deal value.

- Tech companies continue to partner with healthcare companies to help providers store, access, and analyze patient data with hopes of faster and more accurate diagnoses.

VI. Industrial Manufacturing

While an economic slowdown and trade uncertainty may linger, analysts still see positive factors in Industrial Manufacturing for M&A activity.

Highlights:

- High capital availability from private equity and corporate players will drive deal activity. If the economy slows, valuations could fall, providing opportunities for opportunistic buyers with capital on hand.

- However, of concern for the outlook in the sector is the ISM Manufacturing Index, which decreased to 47.8 at quarter end, the lowest since 2009.

- Notable transactions this quarter: Advanced Drainage Systems acquiring Infiltrator Water Technologies and Hillenbrand moving to buy Milacron.

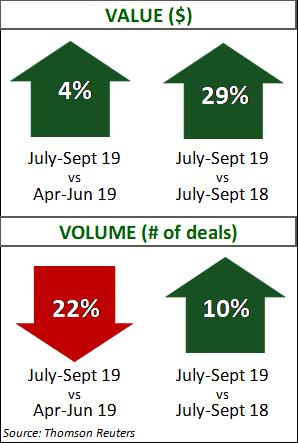

VII. Transportation, Logistics, Distribution

Transportation has been a highlight for M&A activity. Analysts recognize the headwinds from ongoing trade, political, and economic factors, but note the investment across sub-sectors, capital availability, and the demand to link supply chains, which would support on-going M&A activity.

Highlights:

- With increases in the Rail category, as well as continued deal activity in Shipping, Passenger Ground, and Logistics, the sector realized improved deal value and volume year over year.

- The Rail category jumped this quarter, accounting for 34% of total deal value and deal volume within the Rail category up 67% over Q2.

- The Shipping category led the sector in M&A volume with 25% of Q3 deals.

How Can ClearRidge Help You Sell Your Business?

Clients trust ClearRidge to deliver a confidential and discrete preparation and sale process. We remove obstacles to close a transaction and ensure only the most qualified buyers with the capital commitment make it to the closing table.

ClearRidge is the leading M&A advisory firm in our region, closing more transactions than any other firm and recognized for the quality of our work and success at managing and arranging transactions for our clients’ companies. For further information on our team, industry expertise and transactions history, please visit www.ClearRidgeCapital.com.

Sources: This report has been compiled from reports and research including federal data, independent analysis, Reuters, Janes Capital Partners, Kiplinger, PCE-Companies, Mergermarket, PricewaterhouseCoopers, and SDR Ventures.

Note: In the report, you will see that some of the deal data is for larger public companies. The most reliable and timely data tends to be for the larger companies in each industry; however, deal activity of the largest corporations is also a good barometer for M&A activity among midsized companies in the same industry.

For further information, please visit www.ClearRidgeCapital.com