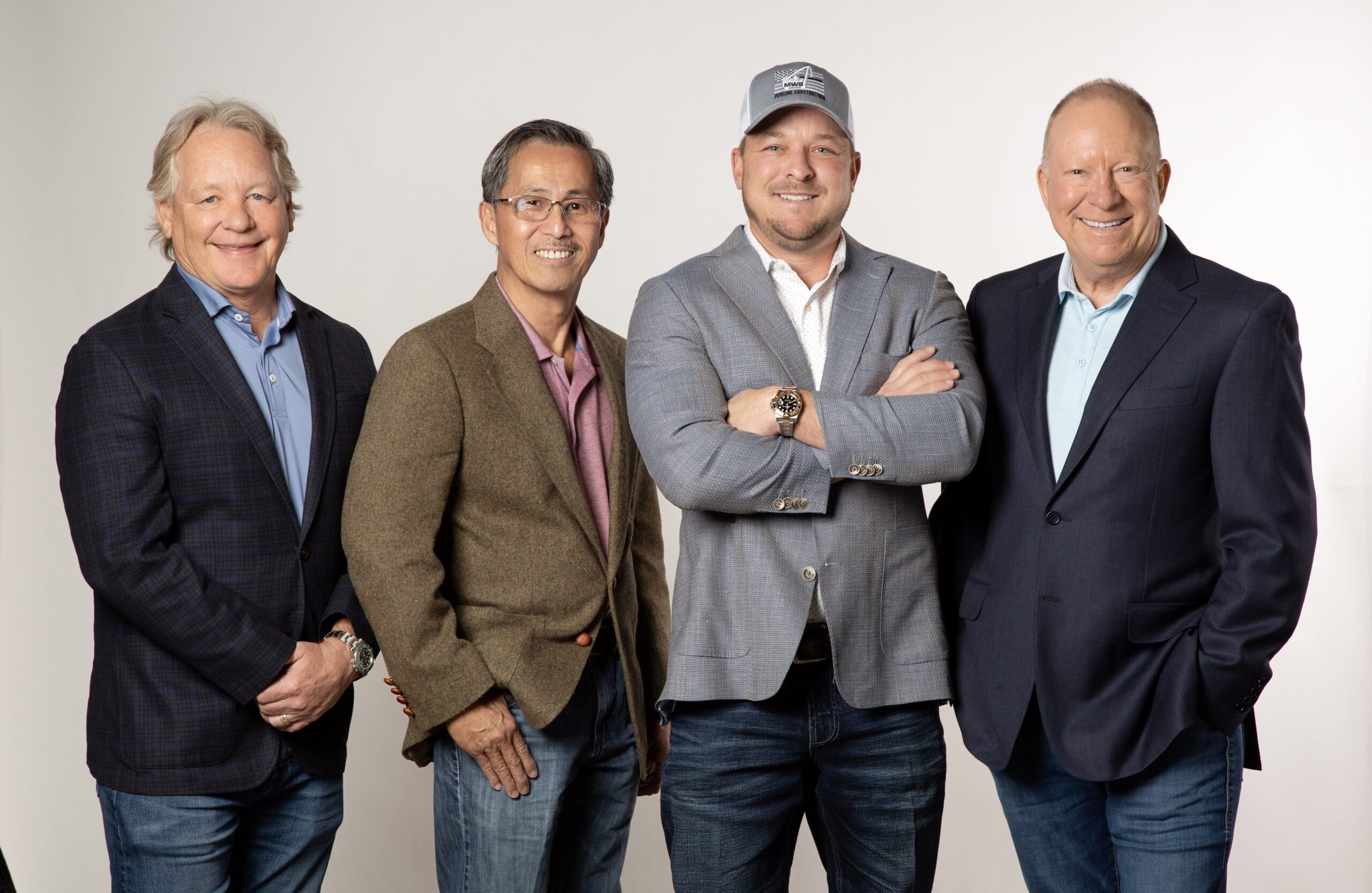

Laser Specialties, Inc. has been acquired by Summit Steel Fabricating. Laser Specialties is a full-service custom and contract metal manufacturing company. Founded in 1993, LSI operates out of a 131,000 sq ft campus in Tulsa, Oklahoma and has over 55 employees, with a client list that includes OEMs, Military Products, Environmental, Energy, Construction, Transportation, and Agriculture. The owners of LSI engaged ClearRidge to represent them in the sale. With an exhaustive process to prepare LSI, identify and approach potential acquirers, the ClearRidge team managed the sale process, and due diligence.